.jpeg)

EDUCATION IN FOREX TRADING

FOREX TRADING : Beginner's Guide

WHAT IS FOREX?

Forex, Also Known As Foreign Exchange Or FX Trading, Is The Conversion Of One Currency Into Another. It Is One Of The Most Actively Traded Markets In The World, With An Average Daily Trading Volume Of $5 Trillion.

The Foreign Exchange Market (Forex, FX, Or Currency Market) Is A Global Decentralized Or Over-The-Counter (OTC) Market For The Trading Of Currencies. This Includes All Aspects Of Buying, Selling And Exchanging Currencies At Current Or Determined Prices. Trading Forex Has Long Been A Popular Choice For Investors. Forex, Or FX Trading, Is The Largest And Most Liquid Market In The World, With Daily Trades Running Into Trillions Of Dollars. Currencies Are Traded In Pairs, With The USD And The EUR Being The Most Common Traded Currency And Counter Currency. Currency Trading Carries A Level Of Risk But Can Also Turn A Huge Profit For Successful Traders The Forex Market Is Open 24 Hours A Day, Five And A Half Days A Week, And Operates Across Nearly Every Time Zone, Which Makes For An Active Market In A Continual State Of Flux, With Prices Changing All The Time.

HOW TO TRADE FOREX

The Forex Market Is Open 24 Hours A Day, Five Days A Week Across Major Financial Centers Across The Globe. This Means That You Can Buy Or Sell Currencies At Any Time During The Week.

From A Historical Standpoint, Foreign Exchange Trading Was Largely Limited To Governments, Large Companies, And Hedge Funds. But In Today’s World, Trading Currencies Is As Easy As A Click Of A Mouse. Accessibility Is Not An Issue, Which Means Anyone Can Do It. Many Investment Firms, Banks, And Retail Forex Brokers Offer The Chance For Individuals To Open Accounts And To Trade Currencies.

When Trading In The Forex Market, You’re Buying Or Selling The Currency Of A Particular Country, Relative To Another Currency. But There’s No Physical Exchange Of Money From One Party To Another. That’s What Happens At A Foreign Exchange Kiosk—Think Of A Tourist Visiting Times Square In New York City From Japan. He May Be Converting His Physical Yen To Actual U.S. Dollar Cash (And May Be Charged A Commission Fee To Do So) So He Can Spend His Money While He’s Traveling. But In The World Of Electronic Markets, Traders Are Usually Taking A Position In A Specific Currency, With The Hope That There Will Be Some Upward Movement And Strength In The Currency They’re Buying (Or Weakness If They’re Selling) So They Can Make A Profit.

A Currency Is Always Traded Relative To Another Currency. If You Sell A Currency, You Are Buying Another, And If You Buy A Currency You Are Selling Another. In The Electronic Trading World, A Profit Is Made On The Difference Between Your Transaction Prices.

UNDERSTANDING CURRENCY PAIRS

All Transactions Made On The Forex Market Involve The Simultaneous Purchasing And Selling Of Two Currencies. These Are Called ‘Currency Pairs’, And Include A Base Currency And A Quote Currency. The Diagram Below Represents The Forex Pair EUR/USD (Euro/US Dollar), One Of The Most Common Currency Pairs Traded On The Forex Market.

When Trading Currencies, They Are Listed In Pairs, Such As USD/CAD, EUR/USD, Or USD/JPY. These Represent The U.S. Dollar (USD) Versus The Canadian Dollar (CAD), The Euro (EUR) Versus The USD And The USD Versus The Japanese Yen (JPY).

There Will Also Be A Price Associated With Each Pair, Such As 1.2569. If This Price Was Associated With The USD/CAD Pair It Means That It Costs 1.2569 CAD To Buy One USD. If The Price Increases To 1.3336, Then It Now Costs 1.3336 CAD To Buy One USD. The USD Has Increased In Value (CAD Decrease) Because It Now Costs More CAD To Buy One USD.

BASIC FOREX TERMS

BID PRICE: The Bid Price Is Simple The Value At Which A Trader Is Prepared To Sell A Currency.

ASK PRICE: The Ask Price Is Simple The Value At Which A Trader Accepts To Buy A Currency.

Note: Forex Prices Are Often Quoted To Four Decimal Places Because Their Spread Differences Are Typically Very Small. However, There Is No Definitive Rule When It Comes To The Number Of Decimal Places Used For Forex Quotes.

On The Forex Market, Trades In Currencies Are Often Worth Millions, So Small Bid-Ask Price Differences (I.e. Several Pips) Can Soon Add Up To A Significant Profit. Of Course, Such Large Trading Volumes Mean A Small Spread Can Also Equate To Significant Losses.

Always Trade Carefully And Consider The Risks Involved.

SPREAD: A Spread Is The Difference Between The Ask Price And The Bid Price. In Other Words, It Is The Cost Of Trading.

For Example, If The Euro To US Dollar Is Trading With An Ask Price Of 1.0918 And A Bid Price Of 1.0916, Then The Spread Will Be The Ask Price Minus The Bid Price. In This Case, 0.0002.

PIPS: A Point In Price – Or Pip For Short – Is A Measure Of The Change In A Currency Pair In The Forex Market.The Acronym Can Also Stand For ‘Percentage In Point’ And ‘Price Interest Point’. A Pip Is Used To Measure Price Movements, And It Represents A Change In A Currency Pair. Most Currency Pairs Are Quoted To Five Decimal Places. For Example:

1.0918 – 1.0916 = 0.0002 (2 Pips)

LOT SIZE: Lot Size Basically Refers To The Total Quantity Of A Product Ordered For Manufacturing. In Financial Markets, Lot Size Is A Measure Or Quantity Increment Suitable To Or Précised By The Party Which Is Offering To Buy Or Sell It. In Other Words It Is The Amount Of Cash You Place On Your Trades. The Lesser You Place The Lesser You Earn/Loss While the More You Place the More You Earn/Loss.

LEVERAGE

The Forex Market Allows For Leverage Up To 50:1 In The U.S. And Even Higher In Some Parts Of The World. That Means A Trader Can Open An Account For $1,000 And Buy Or Sell As Much As $50,000 In Currency, For Example. Leverage Is A Double-Edged Sword; It Magnifies Both Profits And Losses.

WHAT IS MARGIN IN FOREX?

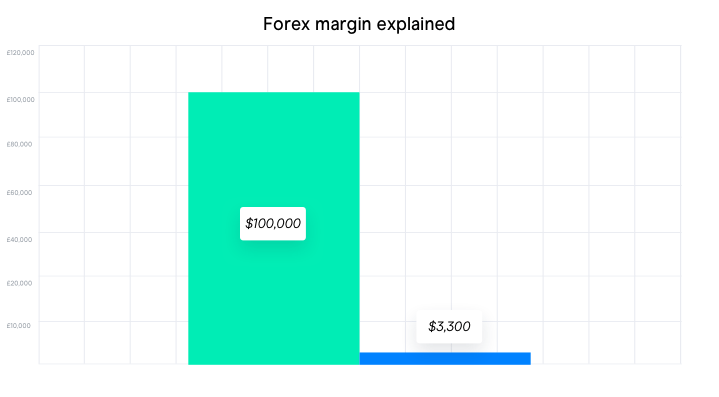

Margin Is The Amount Of Money That A Trader Needs To Put Forward In Order To Open A Trade. When Trading Forex On Margin, You Only Need To Pay A Percentage Of The Full Value Of The Position To Open A Trade.

Margin Is One Of The Most Important Concepts To Understand When It Comes To Leveraged Forex Trading. Margin Is Not A Transaction Cost.

Trading Forex On Margin Enables Traders To Increase Their Position Size. Margin Allows Traders To Open Leveraged Trading Positions, Giving Them More Exposure To The Markets With A Smaller Initial Capital Outlay. Remember, Margin Can Be A Double-Edged Sword As It Magnifies Both Profits And Losses, As These Are Based On The Full Value Of The Trade, Not Just The Amount Required To Open It.

The Leverage Available To A Trader Depends On The Margin Requirements Of The Broker, Or The Leverage Limits As Stipulated By The Relevant Regulatory Body, ESMA For Example. Margin Requirements Differ Depending On Forex Brokers And The Region Your Account Is Based In, But Usually Start At Around 3.3% In The UK For The Most Popular Currency Pairs. For Example, If A Forex Broker Offers A Margin Rate Of 3.3% And A Trader Wants To Open A Position Worth $100,000, Only $3,300 Is Required As A Deposit To Enter The Trade. The Remaining 96.7% Would Be Provided By The Broker. The Leverage On The Above Trade Is 30:1. As Trade Size Increases, So Does The Amount Of Margin Required. Margin Requirements Can Also Differ If You Are Categorised As A ‘Professional Client’.

Margin Explained

MARGIN

Having a good understanding of margin is very important when starting out in the leveraged foreign exchange market. It’s important to understand that trading on margin can result in larger profits, but also larger losses, therefore increasing the risk. Traders should also familiarise themselves with other related terms, such as ‘margin level’ and ‘margin call’.

What is the margin level?

When a forex trader opens a position, the trader’s initial deposit for that trade will be held as collateral by the broker. The total amount of money that the broker has locked up to keep the trader’s positions open is referred to as used margin.

As more positions are opened, more of the funds in the trader’s account become used margin. The amount of funds that a trader has left available to open further positions is referred to as available equity, which can be which can be used to calculate the margin level.So margin level is the ratio of equity in the account to used margin, expressed as a percentage.

The formula to calculate margin level is as follows:

Margin level = (equity / used margin) x 100

For example, let’s say a trader places $10,000 in a forex account and opens two forex trades.

The broker requires a margin of $2,500 to keep these two positions open, so the used margin is $2,500. In this scenario, the margin level is ($10,000 / $2,500) x 100 = 400%. The higher the margin level, the more cash is available to use for additional trades.

When the margin level drops to 100%, all available margin is in use and therefore, no further trades can be placed by the trader.Paying attention to margin level is extremely important as it enables a trader to see if they have enough funds available in their forex account to open new positions.

The minimum amount of equity that must be kept in a trader’s account in order to keep their positions open is referred to as maintenance margin. Many forex brokers require a minimum maintenance margin level of 100%.

SUMMARY

In leveraged forex trading, margin is one of the most important concepts to understand. Margin is essentially the amount of money that a trader needs to put forward in order to place a trade and maintain the position. Margin is not a transaction cost, but rather a security deposit that the broker holds while a forex trade is open.

Trading currencies on margin enables traders to increase their exposure. Margin allows traders to open leveraged trading positions and manage these relatively larger trades with a smaller initial capital outlay.

If a broker offers a margin of 3.3%, the leverage available is 30:1. This means that the trader can trade $100,000 with an outlay of just $3,300. Margin level refers to the amount of funds that a trader has left available to open further positions.When margin level drops to 100%, all available margin is in use and the trader can no longer open new trades.

If the margin level falls below 100%, the amount of money in the account can no longer cover the margin required to keep the position open. When this happens, a margin call will occur and the broker may close some of the trader’s positions if the margin call is not met to bring the equity in the trading account back up to the minimum value.

Traders should take time to understand how margin works before trading using leverage in the foreign exchange market.

It’s important to have a good understanding of concepts such as margin level, maintenance margin and margin calls.

Traders need to be aware that their forex positions could be liquidated if their margin level falls below the minimum level required.

MONEY MANAGEMENT AND TRADE GUIDE

Next, we will discuss about some tips that you might find useful on money and trade management. Please read carfully.

1. Understanding The Fundamentals

2. Gain Knowledge From The Experts

3. Know Your Tools

4. Have A System/Trading Plan in Trading

5. Have control over your emotions

6. Respect money management

7. Curb your greed

8. Learn to accept losses

9. Equip yourself with detailed Forex Knowledge

READ CAREFULLY!

Money management is very important as a trader. Whether you are a stock trader, forex trader, or option trader.

By using money management you can stay alive longer in the game. The more you are in the game, the higher your chances of winning!

Trading can be a successful venture, but of course it is important to keep in mind that this project is not for everyone.

Indeed, there are numerous threats and concerns associated with trading but if you are someone who is relaxed with all these threats, working out business and making money in trading can be a good venture.

Understand the fundamentals

With threats and concerns associated with dealings, it is significant that you know everything about it before putting your money in danger.

Of course, with such a dangerous challenge, you would not also want to add more to your threat by interesting in dealing without understanding the considerations about it.

Gain knowledge from Experts

Knowledge from an expert in learning how to trade helps a lot as well to understand from those who at least have been effective in earning money in dealing.

Find out from their errors and become familiar with a few tips on how you can reduce the hazards associated with trading.

Know your tools

Although there are no fix rules that can ensure your winnings in trading, there are however tools that can help you minimize risks and increase your chances in making profits.

With the advent of the internet, online trading has also become possible and even convenient and easy.

Have a system in trading

Having a system in trading will also help you minimize risks and can help you make better and wiser decisions in trading.

Although there is no system that can ensure your success in trading, but developing your own system/trading plan and sticking into it can be of big help.

Have Control Over Your Emotions

Your emotions play a VERY important role in trading and it can even affect in

making trading decisions. Good traders are often quick decision makers and knows how and when to accept losses.

Stay cool. Avoid being carried away by your emotions while trading, as this can cloud your wise decisions and may not be good for you.

Manage your money

Trading indeed involves money and without proper money management, you may end up depleting your bankroll and you may know it only when everything is gone.

Help yourself by setting an amount that you are willing to invest on trading and make sure also that this is an amount that you are willing to lose.

Curb your greed

Learning how to trade is not just about the technical and fundamental analysis.

It's also about controlling your greed and having the discipline to do so. If you have been losing, then try to know when to stop to avoid further losses.

Equip yourself with detailed Forex knowledge

Last but not the least is to equip yourself with detailed forex knowledge before calling yourself a trader! There are a lot of social media influencers online that are into forex.

Most of them sell their courses and webinars. Try to buy one or two forex courses from those forex gurus. Most of them have everything you need to know to be a successful trader from the basics.

Don't depend on free YouTube courses because they won't teach you orderly.

These are just few things that you may find useful in learning how to trade. It doesn't matter if you are trading currencies or stocks, these can help you have a good start with trading.

If there are two traders,The first trader risk 5% of his money on each trade.

The second trader risk 10% of his money each trade.

You can see that after 10 loss trade, the first trader will have more money left.

Now that's the importance of money management from the above illustration because the market can be influenced some days due to some factors that you might not observe early.

Also,Sterlingcpu has some offline complete bundle of forex courses. They are good videos that will teach you everything you need to know about Forex Trading from the basics. If you are interested or you need close mentorship, CONTACT US.

Knowledge, experience, hard work, ethics and most importantly discipline, play a vital role in separating traders from gamblers.Traders stay in the game FOREVER while gamblers shine for a SHORT MOMENT before they blow out their account. Before you start funding your accounts and start trading it is important to know what you are getting into.

Sterlingcpu has been in the forex market for many years now. While learning how to trade, check out our INVESTMENT PLANS and grow your money.Trading Forex with a good capital is one secret that most forex mentors won't tell you.

JOIN OUR TELEGRAM GROUP FOR DAILY FOREX SIGNALS, FOREX LECTURES, INVESTMENTS AND MANY MORE.

EVERY ACCOMPLISHMENT STARTS WITH THE DECISION TO TRY! CONTACT US NOW!

WHY CHOOSE US

In a business where most fall short on what they promise to deliver, we stand out

RISKFREE TRADE

Sterlingcpu allows riskfree trades with free risk management system and learning plans to increase your trade knowledge.

Strong Security

Sterlingcpu has the latest encrytion and data protection technologies in the business, keeping your account safe and secure.

Fast Transactions

Our transactions are fast and haslle free, for both withdrawals and deposit, we offer a variety of methods for ease.